Winter 2021

Between Greed and Altruism: A Capitalism That Flows

I was trained in the models of modern economics and yet, as I gained practical experience of business and the world, I came to realise that the models I had taught, learnt and even tried to develop did not describe well the behaviour I saw.

But, I then asked myself, if the managers I was observing were not maximising profits, what were they maximising? If their employees were not maximising their utility, what were they

maximising? And then there was a lightbulb moment. Real people, whether in their personal lives, their business and financial activities, or when they undertook public roles, were generally not maximising anything. They were ‘satisficing’, to use an old Scottish word which was revived in the 1950s by Herbert Simon, a pioneer of artificial intelligence who was awarded the Nobel Prize in economics – finding solutions that were good enough.

The heroes, I discovered, are those people who sought solutions that were good enough – and the measure of their achievement is that, as they implemented these solutions, they flow.

Homo economicus?

Humans are, after all, social animals. We are distinguished from other mammals by our capacity to communicate and cooperate. But modern humans have lived through half a century of individualism which downplays these essential aspects in favour of an almost exclusive emphasis on incentives, as though we resemble Pavlov’s dogs and Skinner’s rats.

Humans compete – for material possessions, for sex, for primacy – but they also cooperate. They need to belong, they need affirmation, and they understand that they can accomplish things through collective action that go far beyond the capacity of any individual. Competition is a spur to effort, innovation and creativity. But cooperation is necessary to make that effort productive. National economic success depends on the effectiveness with which societies manage the tension between the impulse to compete and the pleasure of successful cooperation. So does business success.

Organisations exist because humans can do things collectively that they cannot achieve individually. Rosseau observed that the group could hunt stags while individuals could only catch hares. People establish sports clubs to enjoy the benefits of collective endeavour. Parliament authorised a National Gallery and millions from around the world enjoy the collection. Groups of professionals work together in schools and hospitals and universities because they know that they can better serve students and patients and advance knowledge by sharing their skills and experience than by working independently.

The test of the success of any organisation – the hunt, the sports club, the National Gallery, the school, hospital or university, is that the product of the joint endeavour is more valuable than the product of the sum of individual actions. A portion of stag meat was more satisfying than the whole hare. The National Gallery gives more pleasure to people than the same pictures hung in multiple private locations. The university can deliver a better education if its students can access the wisdom of many scholars. The lonely long distance runner derives pleasure from participation in an organised marathon.

A freshwater perspective

These observations are so immediately consonant with our everyday experience as to seem banal. But modern economists and legal scholars generally offer a different description of the modern firm – an account that pervades social and political economy, from both those who are critical of business and those who applaud it.

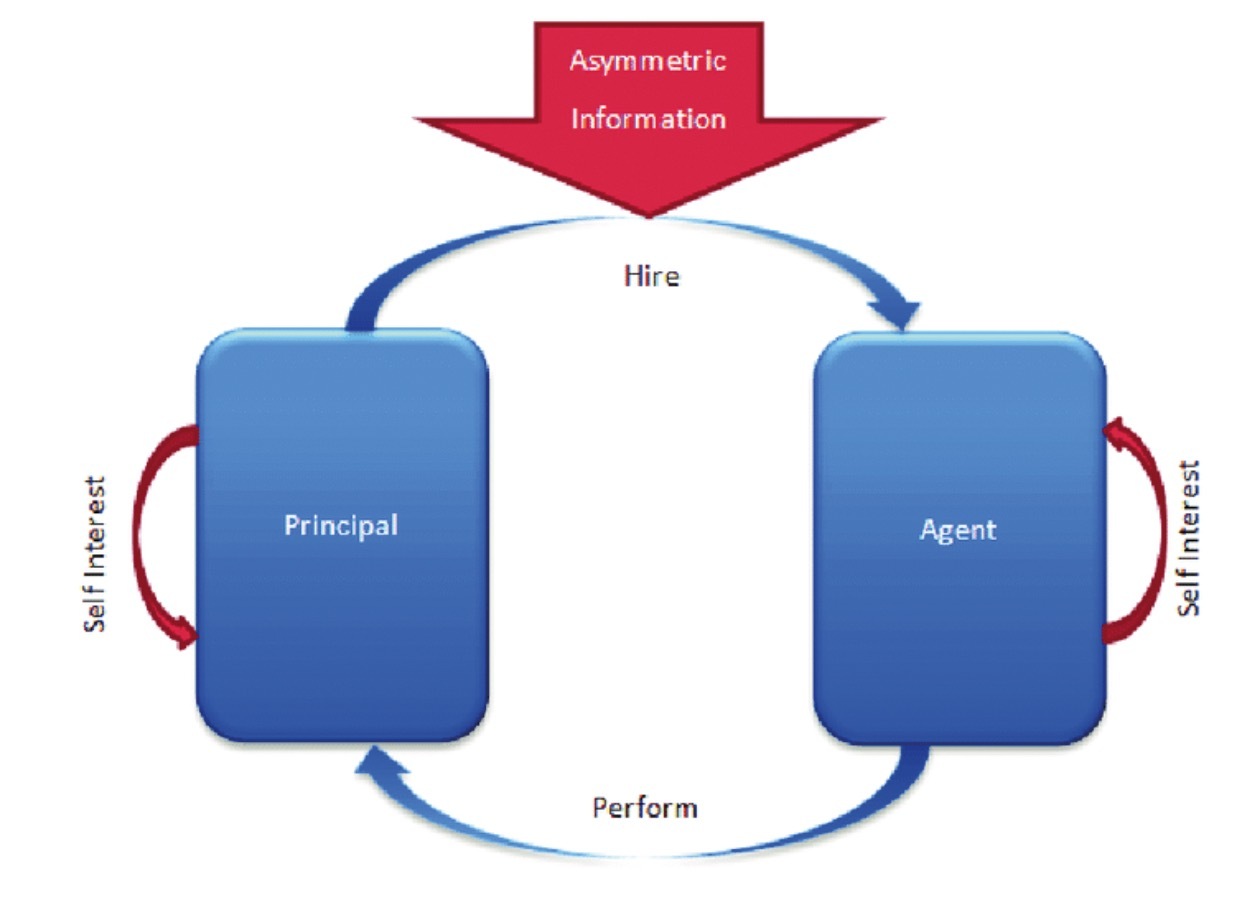

A 1976 article by Michael Jensen and William Meckling is probably the most widely cited modern academic exposition of that model. Jensen and Meckling assert that “most organisations are simply legal fictions which serve as a nexus for a set of contracting relationships among individuals.” Thus the only agents are individuals and all relations are transactional.

Jensen and Meckling were ‘freshwater economists’ at the University of Rochester (the term ‘freshwater’ describes a group of schools of economists, many close to the Great Lakes, led by Chicago and characterised by their strong ideological commitment to free markets). Still, the thesis put forward by Jensen and Meckling is broadly consistent with the Marxist view of the firm. But frequently both left and right agree – when both are wrong.

For Jensen and Meckling, as for Friedrich Engels and Ayn Rand, the firm is a collection of assets, owned by people called capitalists, which employ workers and instruct them to attend their premises and operate their assets. The most senior, titled corporate executives, deliver instructions to subordinate managers, and so on, down the corporate hierarchy.

In modern businesses, managers are often not in a position to monitor directly the adherence of workers to their instructions. Workers themselves may hold critical information not available to their managers. So, the managers must devise incentive schemes that will induce conformity and ensure that workers use their knowledge for the true benefit of the business, rather than themselves.

Both executives and junior employees are thus rewarded by reference to their success in implementing the wishes of the capitalists, which are generally assumed to be to make as much money as possible for themselves.

In this model, individuals are selfish, objectives are narrow and behaviour is instrumental. The firm is no more than a collection of people who find it financially rewarding to do business with each other – for the time being. It is, perhaps, not surprising that so many young people and intellectuals have a poor opinion of capitalism. What is more surprising is that many business people have themselves embraced this description.

’Tain’t what you do (It’s the way that you do it)

Selfishness, narrowness and instrumentality are not inspiring ideals. Business described in this way will attract people who are selfish, narrow in interests and outlook and unembarrassed by instrumental behaviour. And will repel people with loftier ideals and ambitions. Thus the model generates its own confirmatory reality.

But selfishness of motive, narrowness of objective, and instrumentality of behaviour get in the way of the qualities we value in most human activities – such as parenthood or education or scientific research. Some parents are selfish, some teachers are narrow in their conception of the objectives of education, some scientists select results to make claims insufficiently supported by evidence. But we are inclined to think that these things make them poor parents, inferior teachers and bad scientists.

We do not believe that good parents are people whose aim is to ensure that their children supplement their pensions when they grow old; although good parents generally maintain mutually loving and supportive relationships into old age. We do not think that fine teachers are people who devote themselves to improving the grades of their pupils; although we note that the students of fine teachers do well, both in examinations and in life.

When we talk of great scientists we admire not just what they did but the way they did it. From Galileo’s insistence on observation in the face of the authority of the Church to Barry Marshall infecting himself with bacteria in order to investigate the origins of stomach ulcers.

The relationships with others essential to activities such as parenthood, education and sport are valued for themselves, not just for their consequences. Most humans are good at detecting instrumentality – the false bonhomie of the used car salesman, the cynical hypocrisy of the vote seeking politician – and are repelled by it.

So, there is a difference between the firm which promotes the welfare of its employees because executives care, and the firm which promotes the welfare of its employees because its finance department has calculated the net present value of reduced staff turnover. Employees can usually tell which is which.

Source: www.researchgate.net

Satisfaction versus vanity

The majority of human activities are rich and multi-dimensional. Those who participate in them have complex motives and their objectives are multiple and hard to measure.

We would find it difficult to define exactly, or measure precisely, what we mean by a good parent, a fine teacher or a great scientist. Despite that, we would encounter little disagreement as to who were, and were not, good parents, fine teachers, great scientists. Our motives in these activities are neither wholly selfish nor wholly altruistic.

Parenthood is personally satisfying. Vanity, in moderation, is frequently characteristic of the successful teacher or scientist. But if personal satisfaction and personal vanity are all that our parenting, our teaching, or our pursuit of scientific knowledge are about, our performance is rarely successful even, in the long run, in giving us satisfaction or sustaining our vanity. We should think about business in a similarly multidimensional way.

The most influential description of sources of motivation, and the one best known outside academic literature on psychology, is Abraham Maslow’s hierarchy of needs.

People have basic psychological needs for food and shelter, and then for security; once these requirements are satisfied, they are able to seek belonging and affirmation; and then as they achieve these they can pursue the ultimate goal of self-actualisation.

Employees, of course, go to work expecting a paycheck that will fund the groceries and the rent. But in a well-functioning business they also look forward to the camaraderie of the workplace. They welcome acknowledgement of their skills and contributions from their colleagues and bosses. They may take satisfaction from being associated with the creation of fine products and satisfied consumers.

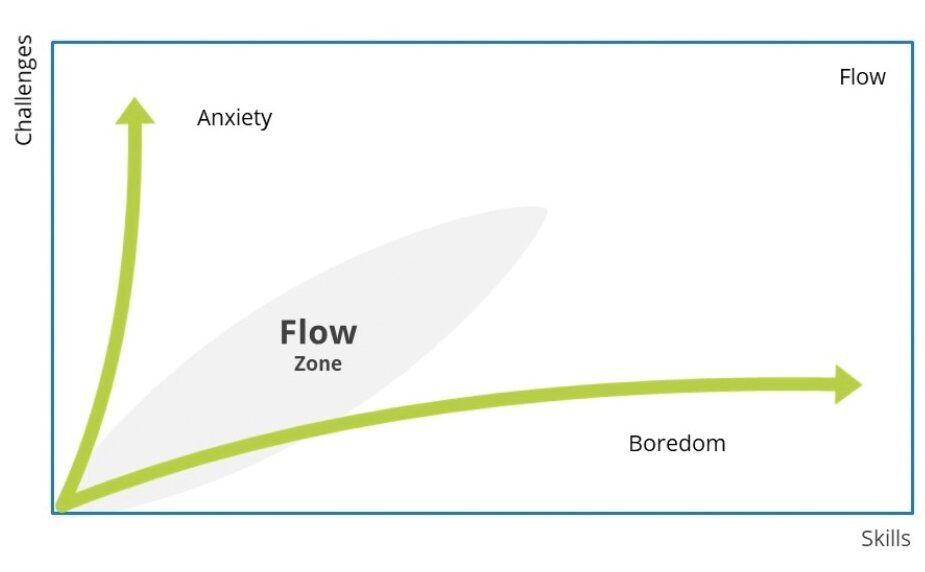

In fact, the psychologist Mihaly Csikszentmihalyi found that when people are asked to report on their current state of happiness, pleasure is found more often at work than at home. And he described ‘flow’, the station which comes from complete engagement in the successful performance of a difficult task.

Flow

‘Flow’ is what drives people to risk their lives climbing mountains. But to recognise the power of flow, watch Lionel Messi’s ‘goal of the (21st) century’ against Getafe in 2007, Diego Maradona’s goal of the (20th) century’ against England in 1986, Claudio Abbado conducting the Berlin Philharmonic Orchestra or Steve Jobs launching the iPhone in San Francisco in 2007.

Source: www.slidemodel.com

I was once at a play in a London theatre starring Sir Alec Guinness when there was a disturbance in the auditorium. Guinness exited the part, pointed at the culprits, and said “would you stop that”, before resuming as if nothing had happened. I had seen a consummate professional in ‘flow.’

But few experiences flatter the ego as much as commanding an audience from a West End stage. Guinness was not performing for reasons of altruism. Messi is the best paid sportsman in the world. It is difficult to see any public benefit from Rheinhold Messner’s solo ascent of Everest – and that was certainly not what he had in mind in undertaking it. In all these cases, self-interest was not the only motive, but undeniably it was a motive.

But I might leave the last word to Steve Jobs: “the only way to be truly satisfied is to do what you believe is good work. And the only way to do great work is to love what you do.”

As with Guinness, Messi and Messner, Jobs’ career illustrates that high professional skill is often associated with extreme self-absorption.

The virtue of proper selfishness

The management guru Charles Handy has written of ‘proper selfishness’ and it is a helpful phrase. Philosopher Anthony Flew explained “when my daughters eat their dinner they are, I suppose, pursuing their own interests. But it would be monstrous to denounce them as selfish hussies, simply on that account. The time for denunciation could come only after one of them had, for instance, eaten someone else’s dinner too.”

The self-interest which dissuades the consumer from buying things to which he or she attaches little value, and dissuades producers from attempting to sell things that will not repay the costs of producing them, is ‘proper selfishness.’

‘Proper selfishness’ is very different from the self-interest famously described by 1980s financier Ivan Boesky; ‘Greed is all right by the way. I want you to know that you can be greedy and still feel good about yourself.’ Boesky’s remark was subsequently caricatured by Michael Douglas as Gordon Gekko; ‘greed is good’.

Most people have little difficulty seeing the difference between proper selfishness and ‘greed is good’; Wall

Street the movie was greeted with a mixture of laugher and disgust (although a financier friend who saw it with colleagues reported that most did not realise that the film was not intended to be a sympathetic portrayal of the Masters of the Universe).

Boesky was subsequently jailed for three and a half years. It was, perhaps, in character that he achieved a substantial reduction in prison time by providing evidence to convict his former associates, some of it obtained by wearing a wire during their illicit conversations.

So – eating your own dinner is ‘proper selfishness’. Eating someone else’s dinner as well is greedy, and is not good.

Happiness

‘Proper selfishness’ is a concept drawn from virtue ethics, an approach to moral philosophy that originated in the work of the Greek philosopher Aristotle. For him, as for most classical thinkers, the goal of life is ‘eudaimonia’ – often translated as ‘happiness’, though most modern scholars agree that this word captures only imperfectly the spirit of the Greek original. Some prefer the term flourishing, others simply leave eudaimonia untranslated.

To talk of happiness leads quickly to the utilitarianism of Bentham, Mill and other nineteenth century philosophers, who sought the greatest happiness of the greatest number. This was certainly not what Aristotle intended; eudaimonia was the outcome of a life well lived, the product not just of worldly possessions but of relations with others – their esteem, their friendship and their love – and it required, in line with the expectations of the polis of classical Athens, a contribution to the life of the community.

Perhaps Sir Philip Green sat on his 100-metre yacht berthed in the harbour at Monaco sipping champagne, oblivious to, or even contemptuous of, the fate of thousands who lost jobs as his retail empires consecutively collapsed, indifferent to the abuse aimed at him in the press and parliament. But if he did, he would be still more deserving of that obloquy. He had achieved great material success, he might be happy, but he would not have achieved eudaimonia.

‘Proper selfishness’ expresses balance and moderation. A legitimate concern for the interests of family, friends and of others as well as oneself, a concern which expresses generosity but does not require one to sell all one’s worldly goods and give the proceeds to the poor. There is plenty of space between St Francis of Assisi and Sir Philip Green.

But moderation and balance also apply to all virtues. To be courageous but not reckless; to praise but not to flatter; to aim to win but to do so within the rules; to criticise justly but not to scorn; to bring up children to be members of family and community while allowing them to develop as individuals. These are the characteristics of good soldiers, good teachers, good sportspeople, good mentors, good parents. And many of us occupy several of these roles simultaneously. The achievement of eudaimonia requires us to act all these parts while maintaining a balance between them – a balance that flows.

Sir John Kay is one of Britain’s leading economists. His interests focus on the relationships between economics and business. This article draws on his thinking for his forthcoming book ‘Business in Society’, which is due for publication in Spring 2023 His latest book Greed is Dead, written jointly with Sir Paul Collier, was published by Penguin Books in July 2020.