Winter 2021

Decentralised Finance: Weaving the Economic Fabric of the 21st Century

Consider two facts

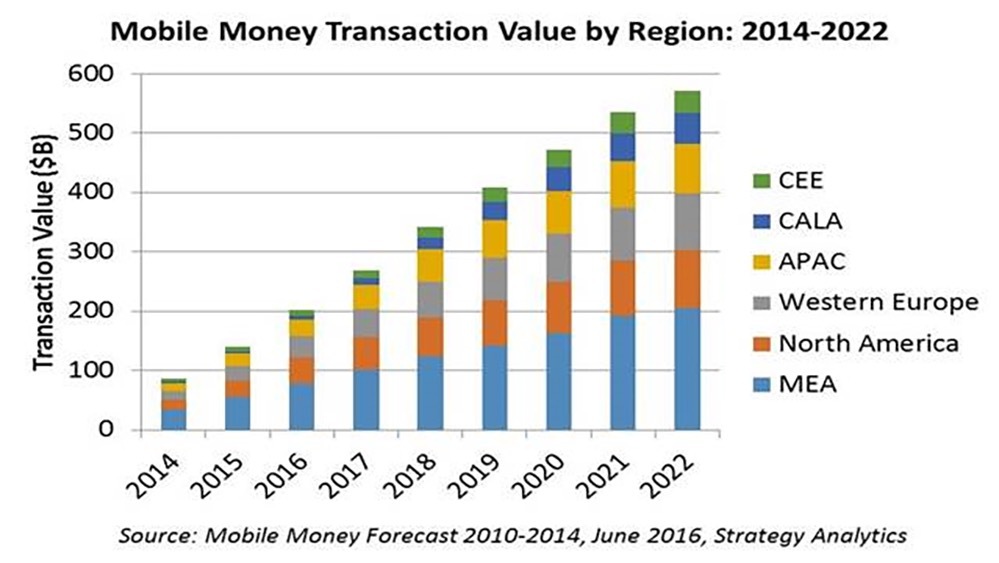

- Half of the world’s population has a smartphone.

- The digital payments market is currently worth over US$ 4 trillion and will reach nearly $US 7 trillion by 2023.

Hold those facts in your mind while you also consider several further points

- Inequality is growing for more than 70% of the global population.

- Six in ten of us say our livelihoods depend on technology.

- Global trust in technology is at an all-time low.

- Nearly seven in ten of us believe big tech has too much power and influence on the economy.

Technology is transforming us. People are more empowered, connected and augmented than ever before. And we are more mobile.

The opportunity for finance, powered by mobile phones connected to a fast internet to redress inequality, to bring more people into the local and global economy, to increase trust and to reduce the power of big tech is real. But will we realise this dream?

There is a strong chance to redress these inequalities and to rebuild trust through decentralised finance.

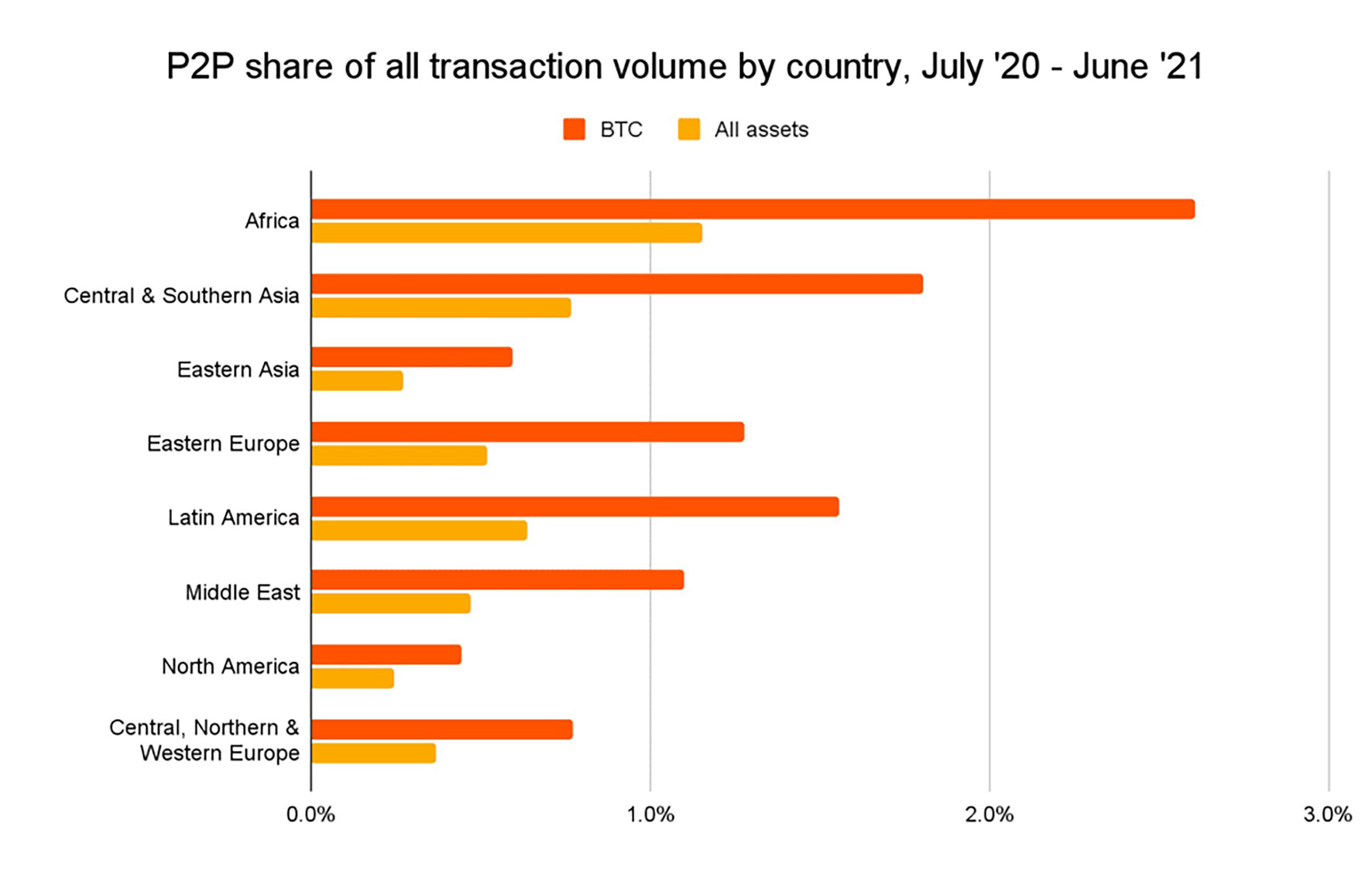

Blockchain, cryptocurrencies and digital finance are already disrupting financial services all over the world, noteably in Africa. The African crypto market has grown by over 1,200% in terms of value received over the past year. Nigerians are the largest users of cryptocurrency in the world, with one in three having used or owned cryptocurrency. Nigeria is the second largest trader of bitcoin.

Source: africaexponent.com

Source: https://tokenist.com

Currency risk

is at its highest in many African countries. For example, Nigeria’s central bank has devalued the Naira, the country’s currency, by around 35% over the past five years. For a country that consumes more imported goods than it exports (except crude oil), constant devaluation erodes the wealth of Nigerians. Nigerians are increasingly turning to cryptocurrency trading platforms to hedge their Naira exposure. Paxful, a peer-to-peer trading platform with 1.5 million Nigerian users and $1.5 billion in trade volume sees more people flowing into the platform with every devaluation.

Remittances are payments sent by migrants to families back home – providing for millions a financial lifeline that supports household spending on food, health, and education in the migrants’ home country of origin. Remittance flows to low – and middle-income countries reached reached $589 billion in 2021, surpassing foreign direct investment and official development aid. Remittance inflows to Sub-Saharan

Africa reached $45 billion. But the cost of these transfers is high – for every $200 sent back to Africa, transaction costs were an additional $19 and can take 24 hours. On peer-to-peer crypto networks, those fees are $5–10 and usually take minutes.

Gaming There are 2.5 billion people gaming on phones all over the world. The use of crypto currencies and NFTs in gaming is only just beginning. Imagine a gamer playing in Uganda, where the points she earns can be streamed into her digital wallet. From there, the cryptocurrency can be exchanged or used to buy real goods. If within a game you win through playing the game a rare asset – a sword, outfit, or car – you can sell it to others within the game for cryptocurrency. Because that asset is on the blockchain, there is only ever one of them. As we see development of Metaverses (online worlds you are inside of, rather than looking at) those assets will be transferable outside of one game, and used in other games in a Metaverse, or in your other digital social networks.

Health Records –

the future of NFTs could well include health records. Your digital wallet will hold your health records from all of your doctors and enable you to share them instantly. Notable alongside the rise of telehealth in Africa.

Supply Chains & Customs clearance –

the sea of red-tape and cost of doing business that mires traditional customs systems in ports, countries and trading blocs keeps small and medium sized business from entering global trade. Blockchain can disrupt that. One blockchain – viewable by all parties – can track delivery, payments, customs clearance, regulatory compliance, proof of shipment, receipt of shipment and proof of delivery. Combined with smart sensors in packaging or containers, it can be easier to get visibility into each stage of the shipment via digital tracking and sign-offs. This application has the possibility to bring millions of smaller African traders into the global economy.

Source: https://mistralmobile.com

Counterfeit goods

Counterfeiting is a US$ 4 trillion problem – in GDP terms somewhere in between Germany and Japan. In Western Africa, 70% of all pharmaceutical products are counterfeit and more than 120,000 people a year die in Africa of fake malaria medicine alone. Technology already exists on legitimate pharmaceuticals identifying where and when the drug was made. Using this data, just as with other goods moving through customs, every move a legitimate drug takes can be traced from manufacturer to distributor, to freight and transport, to customs and finally to the retailer and the consumer, with each step along the way contributing data to a network that can prove the origin of the product, trace its ownership, and provide authentication. The fact that the information in this ledger can be accessed from anywhere in the world using a smartphone means that the consumer has a very real means of ensuring they’re receiving the product they want.

The above examples are available to people who use smartphones. But in large parts of Africa, many people don’t have smartphones.

In Nigeria, smartphone penetration is only 12%. When we ponder how to solve payments problems, and how to increase financial services to the unbanked it is vital to consider using traditional mobile phones, known as feature phones.

Payments via feature phones – Tayo Oviosu, the Founder and Group CEO of Paga, who is building the ‘paypal of Africa’ told me that the network of agents, people who run small stores in their communities have installed small terminals that interact with customer’s feature phones “that only have airtime, no ‘data time’. You dial *242# and a menu comes up – press one to send money, press two to request money, press three to buy airtime, press four to pay your bills. People use the service because they trust the agents who are neighbours and friends that they see every day. 61% of the Nigerian population is unbanked. What this kind of technology does is give them a way to put their money in a secure place (it is insured by the government insurance corporation), use the money and potentially lift themselves out of poverty.“

“In Nigeria, the general rule is that for every one person employed, four adults are depending on them. So increasing trade through the 60,000 agents using Paga has a multiplier effect in terms of the numbers of people positively impacted.

Source: Borgenproject.org

Making digital assets tradeable – how many mobile phone minutes on your monthly contract do you never use? What if you could exchange them for currency to buy something you really would use? It’s early days for Fonbank – but it is doing exactly that, allowing users to trade prepaid airtime credits for cryptocurrency that you can use to buy other goods. Their aim is banking infrastructure using mobile airtime for currency.

The potential for decentralized finance to bring back some of the trust we have lost is exciting. As Mike Novogratz, Chairman and CEO of Galaxy Digital told me, “crypto started as a movement where a group of people said, we don’t really trust the center. We don’t trust these governments, big organizations, big banks anymore. These platforms are building new systems of trust built with transparency. In a world that’s balkanized like our current world, where politics are harder and harder, crypto is kind of a pan-political movement that’s built around this concept of trust through transparency, and I think that’s a spectacularly important idea.”

Decentralized Finance places power in the hands of the consumer, the gamer, the patient, the entrepreneur. It democratizes and makes accessible the previously inaccessible. The next twelve months will continue to bring an onslaught of development in technology. Will it continue to reduce inequality, increase transparency, bring more people out of poverty and increase trust? Perhaps it is on all of us to decide.

Edie Lush has been a political analyst for UBS and is an author, journalist and communication trainer. She is Executive Editor of Hub Culture, Co-Host of the Global GoalsCast podcast and is a regular commentator and broadcaster on technology issues.