Winter 2021

Urban Rise and Fall: Cities of the Future

Which cities are going to be the world’s winners as trading hubs in the 2050s?

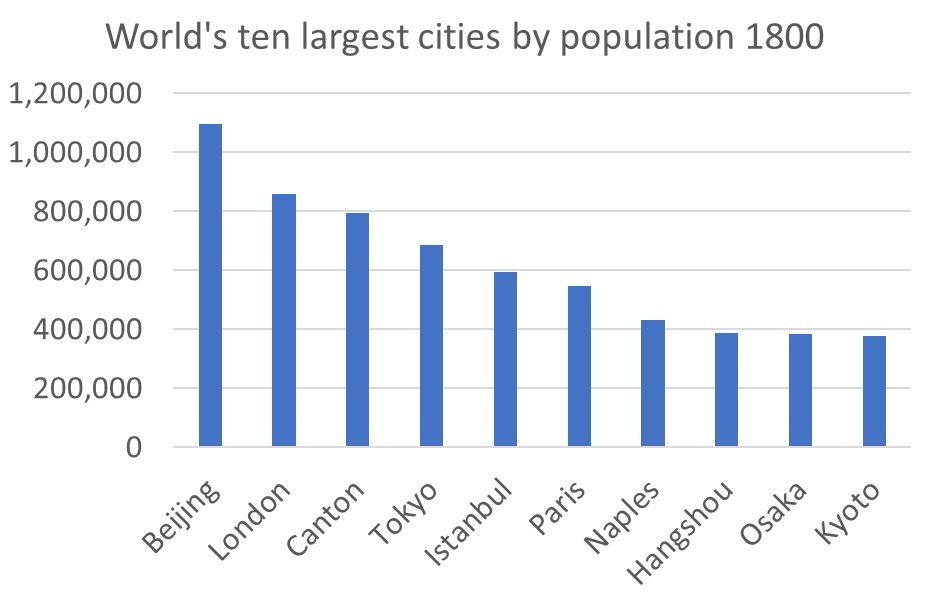

If a similar question were asked about 1800 or 1900 one would probably have listed those cities that had the greatest population.

In 1800 levels of incomes had not diverged enough to create great cities that didn’t have great populations. Figure 1 shows that 6 of the world’s 10 largest cities in 1800 were in Asia; one (Istanbul) part Europe part Asia and only three, London, Paris and, surprisingly, Naples in Europe.

Source: Youtube visualisation https://www.youtube.com/ watch?v=_7jCioztj_c . Data extracted from UN population estimates

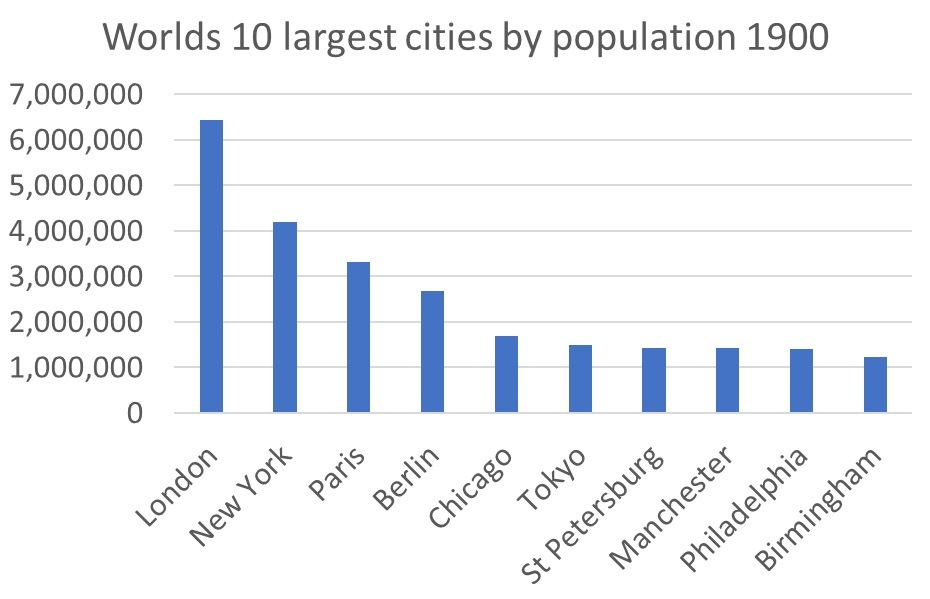

In 1900, industrialisation had caused urbanisation and so the most successful cities were also those with the largest populations. By then, as Figure 2 shows, only one of the top ten cities by population was outside the West.

Despite then accounting for only 2.3% of the world’s population, the UK supplied 3 of the world’s 10 most populous cities. The US population was roughly twice that of the UK and supplied 3 more.

Source: Youtube visualisation https://www.youtube.com/ watch?v=_7jCioztj_c . Data extracted from UN population estimates

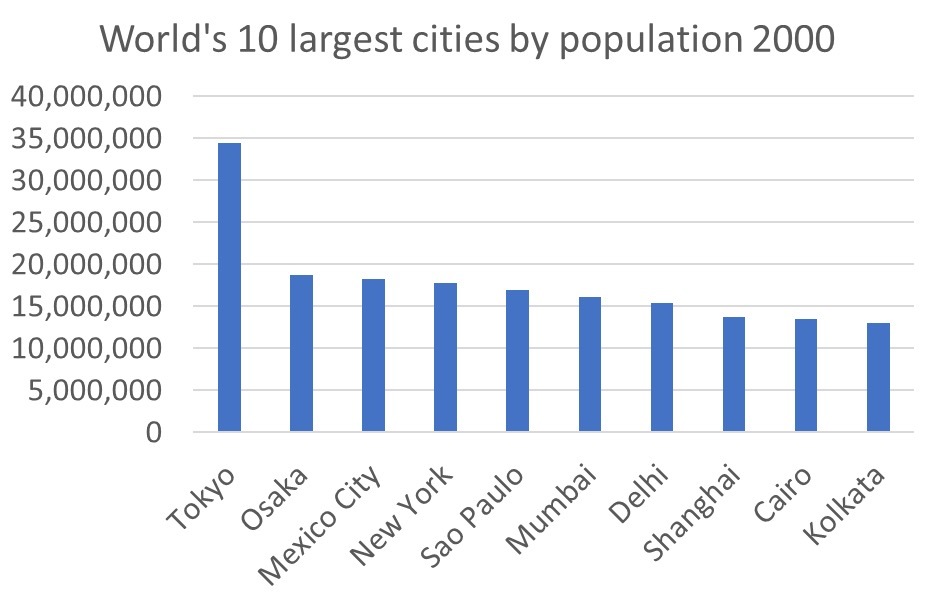

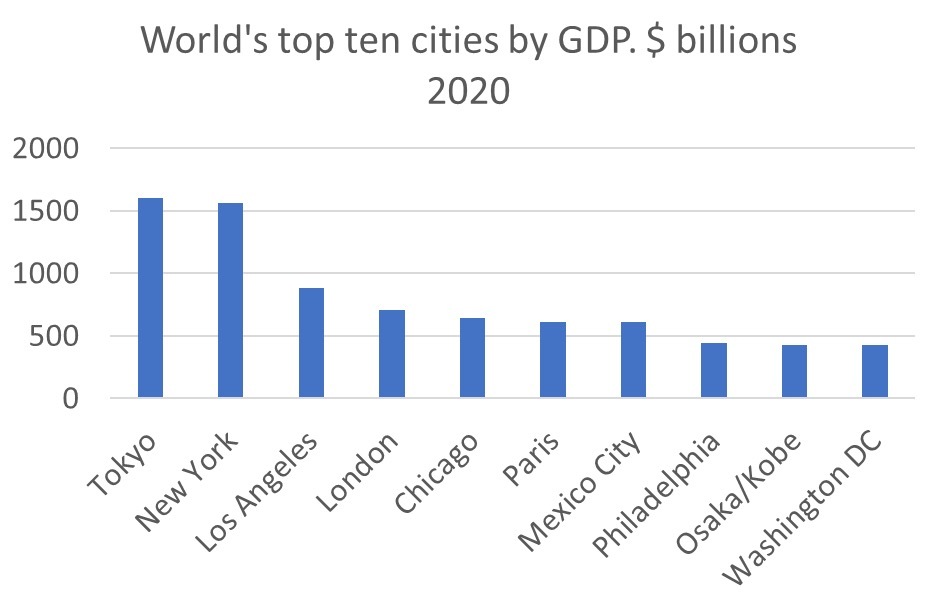

Flashing forward to the turn of the current century Figure 3 shows the top ten by population in 2000. Only Tokyo and New York are outside the emerging economies. The contrast is with the top ten ranked by GDP (for 2020) in Figure 4 where only one city is from an emerging economy. Tokyo, New York and Mexico City are on both lists.

Source: Youtube visualisation https://www.youtube.com/ watch?v=_7jCioztj_c . Data extracted from UN population estimates

Source: Data source: The 150 richest cities in the world by GDP in 2020 http:// www.citymayors.com/statistics/richest-cities-2020.html

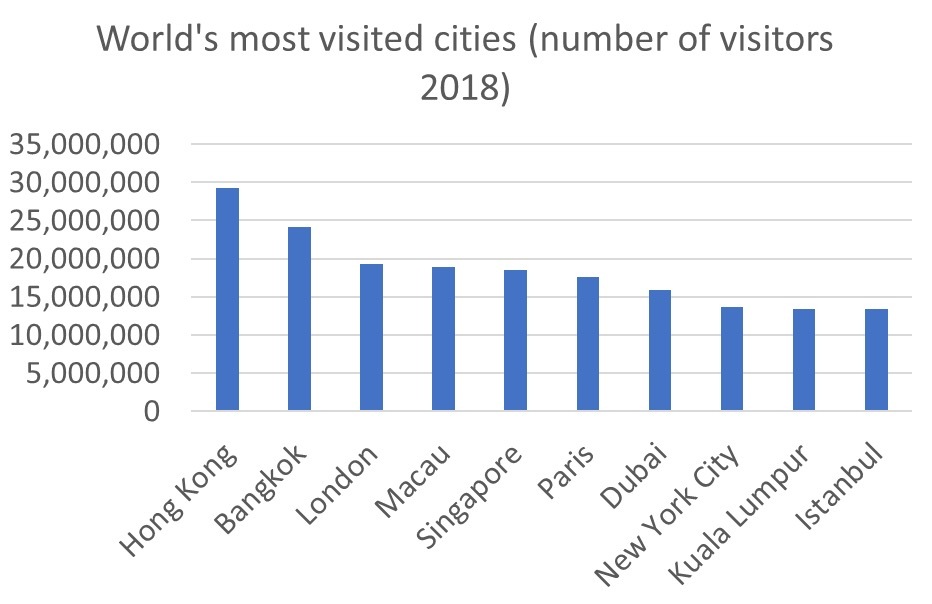

And yet the listing of cities by GDP doesn’t really capture where people want to go. Figure 5 shows the cities that were most visited pre-pandemic and the list differs quite sharply from that of the most economically prosperous. London, New York and Paris are the only cities to make both lists.

Source: There are two sources of data on this. The research company Euromonitor provide one source (used in the graphic); the credit card company Mastercard the other. The Mastercard data gives very different figures for Hong Kong as it excludes short trips from the rest of China.

It is interesting that four out of the top eight most visited cities are also the top four (and a long way ahead of any other) world financial centres. New York, London, Hong Kong and Singapore as financial centres attract substantial wealth, part of which is reflected in their tourist attractions and options for shopping, eating and culture.

Looking forward to 2050 it seems likely that the criteria for places to be aspirational could well change again.

First, tech seems likely to replace finance as the top source of wealth. And the cities that have proved most attractive to tech have been a very different group from those who have become financial centres. And trading hubs are likely to become the centres of digital trade in addition to financial activity.

Second, the hugely increased ability to work remotely will tend to create a much greater degree of disconnect between prosperity earned in a city and the spending of that prosperity in the same city.

Third, innovative transport systems may become a much more important determinant of attractive cities than at present as streets gum up, either from vehicle congestion or from transport measures.

The current population projections shown in Figure 6 suggest that the largest cities by population are mainly going to be in emerging economies.

And yet, while all these cities are likely to show the vibrancy that emerges from teeming masses of people trying to earn a living and rub along, it is not clear how many would attract international visitors en

masse. And indeed their very size may make them hard to visit if size leads to congestion.

The young cosmopolitan workers who have made London a tech centre tend to have views on politics which don’t always fit best with economic development.

India will be the country with the world’s largest population by 2050 and it will be catching up with China and the US to join them as one of the world’s largest economies.

It’s hard to look beyond Mumbai as the present and future economic capital of India, though it is quite likely that Bangalore, with its more pleasant hill station climate at 3,000 feet above sea level, might remain the tech capital. Mumbai will be the world’s largest city by population. And yet, Dubai is fewer than 2,000 kilometres from Mumbai and, with the probability of continued pro business rule, might emerge as India’s back up financial capital in the way that Miami acts for much of Latin America and Singapore for South East Asia. A small shout also for Chennai which shows signs of emerging as a key Indian manufacturing centre.

China will not go away, even if its relationships with the Western world remain strained. Shanghai is more cosmopolitan but Beijing has the greater range of attractions. I’m inclined to think that Hong Kong may lose its special advantages as the one country two systems policy erodes. This is due to expire anyway in 2047, 50 years after the region returned to China in 1997. Shenzhen, only 30 miles from Hong Kong and now just an 18 minute bullet train ride away is catching up fast with Hong Kong as a financial hub and is well ahead as a tech hub. By 2050 too, its population is forecast to reach over 11 million and be bigger than that of Paris.

There is a city well away from popular Chinese East Coast which on many measures is the fastest growing city in the world. Hohhot is the capital of Inner Mongolia. Its population is now about the same size as that of Rome at just under 4 million and its GDP growth is around 20% per annum. It used to be China’s dairy capital and is now the centre for big data. It will benefit as transport links across Eurasia develop.

Source: http://en.hhhtnews.com

Elsewhere in South East Asia, Singapore looks likely to benefit from any movement of business away from Hong Kong to a centre more independent of the Chinese government. It is also in many ways the economic capital of its neighbour Indonesia, set to become one of the world’s top ten economies. Singapore has one of the highest levels of GDP per capita in the world and this fuels its continued success, combined with what is widely admired as one of the world’s most efficient governments.

In the Middle East, Dubai has already been mentioned as an offshore centre for both South Asia and the rest of the Middle East. Presumably the move away from fossil fuels will have some negatives for the major oil and gas producers but it is likely that solar energy will be at its cheapest in the region. Abu Dhabi is so close to Dubai and is also a member of the Gulf Cooperation Council so will probably share in its success – indeed the cities are likely to grow into each other. Dubai is amongst the world’s leaders in flying taxis and other forms of unconventional transport and seems likely to be an early adopter of many new advances in travel. But the Middle East generally is held back by conflict and low levels of educational achievement, now running behind Africa.

Measured as a share of GDP, Israel has the highest percentage of tech with plenty of spillover from the Defence Force. With gradual rapprochement with Sunni Islam, Tel Aviv and Jerusalem could become important centres in the Middle East too.

Meanwhile the Turkish economy seems still to survive despite the unusual economic policies. It’s hard to overlook its central position both between East and West and between North and South. And Istanbul remains a major world tourism destination. The unconventional economic policies that have weakened the lira mean that as a destination it remains highly economic.

Will Africa develop as a key destination within this period? Pre-pandemic South Africa was an important tourism destination. But it still seems hard to see it as having the stability that tends to be necessary for the continent to provide a world leading destination, although in Kinshasa and Lagos it will have two of the largest cities in the world by population.

Latin America has some of the fastest growing populations in the world and in MexicoCity is predicted to have one of the world’s top ten populations by 2050. But with Miami well established as the region’s financial capital and with most Latin American countries having little reputation for economic or political stability, it is likely to remain a secondary rather than primary destination.

Looking at the US, an important feature is that California seems to be entering a period of decline. Tech companies are moving out because of high taxes. The prevalence of homelessness seems to be damaging both Los Angeles and more importantly San Francisco as tourist destinations. The US welfare system seems to create a dynamic where those requiring most welfare support migrate to the cities that are most supportive, pushing up the taxes required to support them.

Although the US has the ability to reinvent itself and should not be written off, one wonders whether the increasingly toxic and polarised politics could tempt some Americans only a short way across the border to Toronto. Obviously temperature counts against but a downtown entirely connected by underground passages provides some compensation.

One assumes that fintech and derivatives will remain critical financial sectors. With Chicago the main financial centre in North America benefitting from its historic specialisation in derivatives and its Golden Mile shopping, it seems likely to remain important for another generation.

Miami is in many ways the economic capital of Latin America and accordingly has one of the highest concentrations of banks in the US other than in Chicago and Wall Street. It seems likely to hold its position.

New York has been written off so many times and yet always bounces back. In recent years it has overtaken London to become the world’s top-rated financial capital on both the most widely quoted measures. The new Mayor, former police captain Eric Adams, has promised a more centrist approach to governing than his predecessor. The big news for the coming years could be a financial merger between New York and the post-Brexit City of London as the Western economies try to regain their economic status. There are a host of regulatory difficulties but if they can be overcome, there is the prospect of a financial powerhouse straddling the Atlantic and two time zones.

Meanwhile Boston remains the East Coast tech capital of the US and has strong positions in both the tech economy and the new medical economy that are emerging. As one of the world’s leading centres for venture capital, it is likely to remain important.

Despite remote working, cities will still have economic relevance

What about the old world?

London is of course established as one of the world’s leading cities. It is the strongest European tech hub, with its so-called Flat White Economy. It leads in fintech and in digital marketing. It remains the world’s number two financial centre and the largest international financial centre. If, as suggested above, the City of London and New York agree to merge their financial centres, London will be given a major boost. In addition London is one of the world’s leading tourist destinations and is one of the world’s largest cities by GDP.

On the other hand, the young cosmopolitan workers who have made London a tech centre tend to have views on politics which don’t always fit best with economic development. Mayor Khan’s anti-car policies have already made London the most congested city in the world according to traffic data monitoring company Inrix. Whereas other congested cities became so as a result of increasing traffic flows, London has uniquely achieved this while the amount of traffic decreased, both resulting from traffic management policies. London will probably keep advancing, but infuriatingly more slowly than it could with better policies.

Stockholm is Europe’s number two tech hub on some measures. Like London, it benefits from talented migrants who are overrepresented in the city’s successful start-ups. One advantage it seems to have over some centres is that its pro gender equality policies have led to a much higher representation of women in tech than elsewhere. Together with a ready supply of venture capital it seems likely to continue to succeed.

Paris seems to be going through a bad patch at present with the hashtag ‘saccage Paris’ going viral last Easter. Although it’s not in fact true that ‘the French have no word for entrepreneur’ (as former President George W Bush apparently claimed) surveys show many fewer signs of entrepreneurship in France than in the Anglo Saxon countries. And yet, there is definitely some post Brexit movement in financial services away from London to other parts of the EU and Paris has been the main beneficiary. And Paris’s natural tourist attractions are unlikely to go away, a factor which will continue to attract residents and visitors.

Amsterdam has also highlighted some post Brexit gains in financial activity from London. And yet it has also lost major companies. While the lifestyle is attractive, the working pattern doesn’t really match the intensity of the main financial centres.

Berlin is also emerging as one of Europe’s secondary tech hubs. With, like the other such hubs in Europe, a highly cosmopolitan population and off the back of Europe’s leading economy, it would seem to have many of the key ingredients for success. Berlin has always had a tradition of a slightly alternative population and such populations have often been breeding grounds for tech success.

Historically the pattern of economic development in cities was that the growth of businesses attracted populations. The modern pattern of digital and creative sectors turns this relationship on its head. Now it is the availability of skills that attracts tech businesses.

This means that despite remote working, cities will still have economic relevance. And if you want your city to prosper and eventually join the world’s leading destinations, the trick is to make it an attractive place in which to reside. Where the skills are, the jobs will come.

Douglas McWilliams is the founder and Deputy Chairman of Cebr, the economics consultancy.