Winter 2016

The Collapsing Cult of the Expert

The populist revolt against elites and policy experts cuts across categories, from foreign policy to domestic policy to science. In the 1990s, the leaders of the big western democracies could persuade their voters of the case for peacekeeping and even peacemaking; now the vacuum that is Syria telegraphs a chastened consensus. In the 1990s, technological advance was celebrated; now Silicon Valley stands accused of hoarding citizens’ personal data and robots are suspected of stealing jobs. But the clearest populist challenge is directed squarely at the economic technocrats. Free trade, open migration policies, budget discipline, and central bank independence can no longer be taken for granted. The common understanding of what constitutes sound policy faces a severe contest.

The populists’ challenge to the case for globalisation is the most obvious part of their revolt against the economic consensus. In the aftermath of the 2008 crisis, economic policy elites quietly abandoned their faith in financial globalisation, embracing regulations that restrict cross-border lending by global banks. But the expert consensus in favour of free trade and migration remains almost as strong as ever. Trade boosts economic output by allowing companies to reap economies of scale, by heightening competition and so driving gains in productivity, and by encouraging countries to specialise in whatever they do best. Likewise, migration allows workers to move to places where they will be most productive, so that mining experts can find their way to Australia, insurance experts to London, software geeks to northern California, and so on.

Of course, not everybody gains from this growth-enhancing globalisation. But, according to the best research in economics, the problem of rising inequality has more to do with technological change than with migration or trade. Economic studies of migration find that, contrary to myth, low skilled native-born workers do not suffer wage losses as a result of competition from migrants, partly because they shift into jobs requiring native language skills, for which migrants represent little competition. Equally, the effect of trade on inequality is ambiguous: to the extent that trade boosts productivity, it creates space for some workers to be paid more. In any event, the answer to inequality lies in redistributive tax and spending policies. It does not lie in obstructing globalisation.

In Brexiting Britain, Donald Trump’s America, and potentially elsewhere, populists reject this consensus. The British referendum mandate to leave Europe promises a radical experiment in deglobalisation—a double-barreled rejection of liberal migration and liberal trade. According to (imperfect) opinion surveys, Britons’ desire to restrict inward migration is especially determined; they evidently did not value their membership of the European Single Market sufficiently to want to stay in the Union. Barring a surprise, Britain’s EU exit will involve restrictions on migration from Europe and the sacrifice of full membership of the Single Market, though the country may aspire – successfully or unsuccessfully – to retain some form of privileged trade access.

The impact of President-elect Trump is harder to judge, both because his electoral mandate is less specific and because his style is so mercurial. New trade agreements, notably the Trans-Pacific Partnership and the Transatlantic Trade and Investment Partnership, already faced political resistance in the US Congress and are now a dead letter, with costs both economic and strategic; the Pacific deal, in particular, was the cornerstone of US-Asia strategy, and its failure will create a vacuum to be filled by alternative trade arrangements, perhaps centered around China. Whether Trump goes further and dismantles existing trade agreements is less certain. During his campaign, Trump railed against the North American Free Trade Agreement and promised to tear it up, which he has the power to do if he so chooses. But the president-elect is probably willing to preserve Nafta if Canada and Mexico are willing to grant him some face-saving concessions. How big those concessions need to be is probably unclear even to Trump.

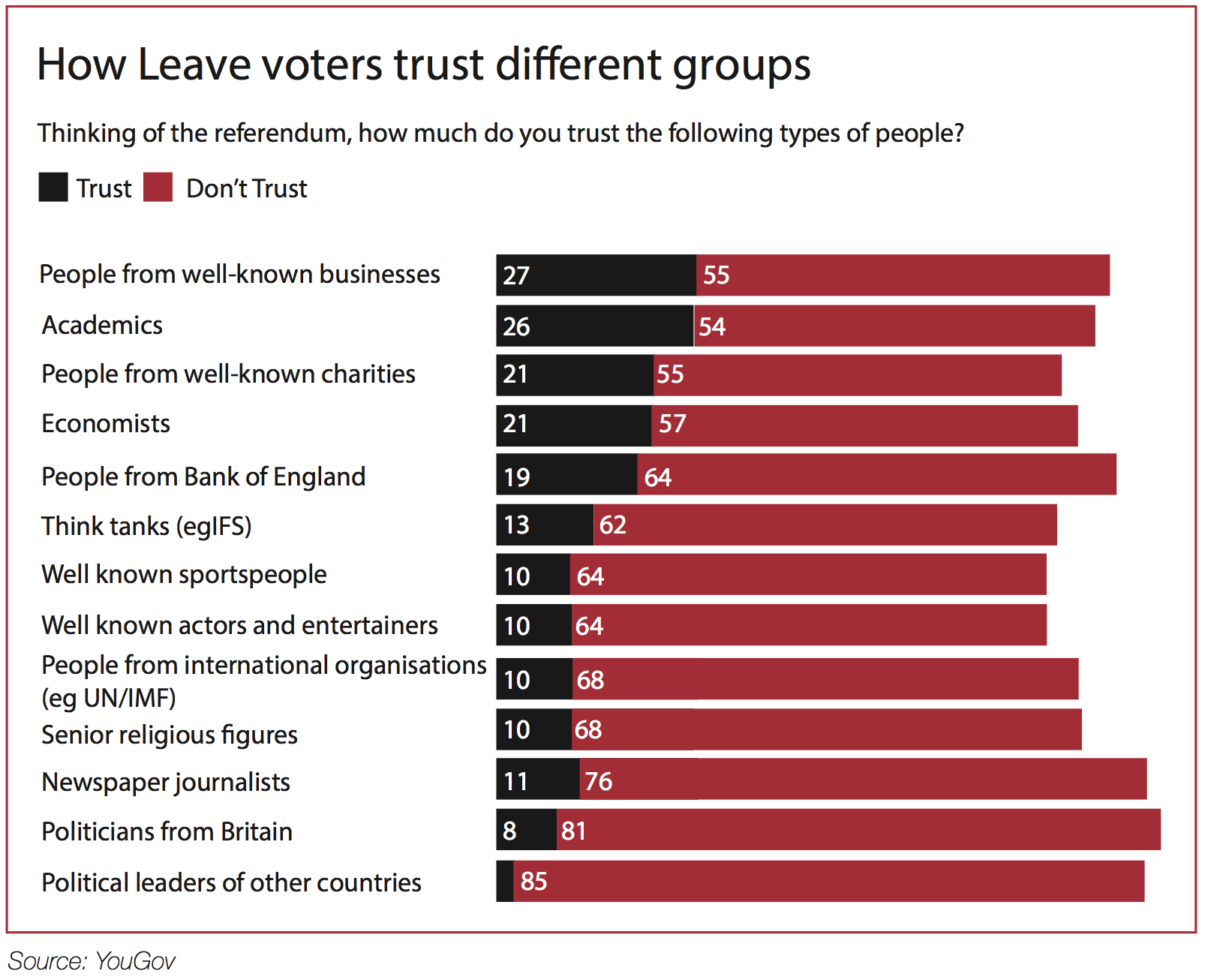

Source: YouGov

The president-elect is also likely to use his considerable executive powers to hit trading partners with unilateral tariffs, punishing them for allegedly “unfair” practices. The US Treasury may formally designate China as a currency manipulator, potentially setting the stage for punitive US sanctions on the country, perhaps prompting the Chinese to hit back. If Trump does go forward with this course, it will be ironic, since it has been some time since China intervened to keep its currency cheap and its exporters artificially competitive; over the past year or so, the government has intervened in the opposite direction, propping up the RMB’s value and making Chinese exporters less competitive. But, evidently recalling the period a few years ago, when China genuinely was manipulating its currency, Trump appears to be caught in a time warp.

Trump has also pledged to clamp down on migrants, both by preventing new arrivals and by evicting illegals already in the United States. During the campaign, he promised to pursue these goals with uncompromising ardor, but since the election he has moderated his message. He now allows that some low-skilled migrants may contribute to the US economy, an observation presumably encouraged by his long experience of employing them on construction sites. The best guess is that Trump’s crack down will be less draconian than his rhetoric. If he deports some illegal migrants, he will merely be continuing the policy of the Obama administration. And since many undocumented foreigners in the United States arrive legally and then overstay their visas, Trump will not prevent more illegals from arriving, even if he does construct a wall on the Mexican border. In sum, Trump’s hostility to migration may change the status quo less than his antipathy to trade deals and his apparent determination to pick a fight with China over supposed currency manipulation.

The populists’ attack on globalisation is coupled with impatience with other aspects of the technocratic consensus, notably a disciplined and sober commitment to stable growth. After all, the essence of populism – the reason why it can be popular – is that it promises an immediate rush of prosperity, even if the sugar high ends badly. On budget policy, populists embrace tax cuts or extra public spending, either of which pump up demand and hence the growth rate – until the problem of too much demand chasing too little supply causes inflation. On monetary policy, populists tend to resent central banks that raise interest rates to head off these inflationary pressures. Tighter money dampens growth in the short term, and populists are short-termist.

Strangely, it’s possible that these normally disastrous populist instincts could do inadvertent good because of the way the global economy is positioned. Since 2008, the advanced nations have been stuck in a low inflation, low growth, low interest rate slump, frequently known as “secular stagnation” or, alternatively, the “Japan trap”. A blast of budget stimulus could be just what the doctor ordered to escape this predicament. Indeed, even before Brexit and the Trump election, mainstream economists were calling on governments to deliver just such a stimulus. Central banks had gone as far as they could with unconventional monetary measures, discovering that some of them – for example, negative interest rates – could damage banks, weakening the economy rather than stimulating it. The job of pumping up demand therefore had to be transferred to the budget. In signaling a willingness to expand the budget deficit, Theresa May’s government and president-elect Trump appear to be answering this call.

The danger, however, is that today’s populists may go too far, not so much in the United Kingdom, where it seems that deficit expansion will be kept within a reasonable range, but rather in America. The Trump programme combines promises of tax cuts with an infrastructure splurge – this at a time when demand is already in danger of growing faster than supply, threatening inflation. According to the government’s preliminary estimate, the economy expanded by an annual rate of 2.9 percent in the third quarter of 2016, considerably above estimates of the sustainable non-inflationary rate. Headline unemployment is below 5 percent, meaning that it may be hard to expand output to keep up with hot demand unless workers are motivated with pay rises.

On top of the worry of too-hot demand, Trump threatens to exacerbate inflationary pressure if he goes through with his attacks on globalisation. Punitive tariffs on China or a withdrawal from existing trade treaties would obstruct cheap imports, raising prices to US consumers. A trade war could also play havoc with manufacturers’ supply chains, harming productive capacity and so giving a further upward lift to inflation. A clampdown on migration, if it did go beyond the eviction of illegal workers practiced by Obama, would only add to the dangers. Fewer foreign workers would reduce the economy’s supply capacity, further stoking inflation.

All of which sets Trump up for a clash with the Federal Reserve. Already during his campaign, Trump proved himself willing to attack Janet Yellen, the Fed chair, in a manner unheard of for a politician of his stature in the past quarter of a century. If the Fed responds to Trump’s excessive budget stimulus by raising interest rates, Trump will acquire an additional motive to attack the central banks, never mind the tradition that it should be treated as independent. Higher interest rates would mean a stronger dollar, which would in turn mean weaker US exports and extra imports – exactly the opposite of what Trump promised as a candidate. It is easy to imagine Trump trying to prevent the Fed from raising rates, since he will not want to lose the support of manufacturing workers.

If Trump does try to subjugate the Fed, he will find it alarmingly easy. Unlike the Supreme Court, whose independence is specified in the constitution, the Fed is independent by virtue of convention. It set interest rates independently in the 1950s and early 1960s, because the Eisenhower and Kennedy administrations were content to allow it to do so; it lost its independence from the mid 1960s until the late 1970s, because a succession of presidents were determined to bully it. Today, Trump has the advantage that two of the seven seats on the Federal Reserve Board are vacant. He can put his allies in those slots, and look forward to more vacancies soon. Pretty soon, he may have the central bank he wants – and the United States will run the risk of a return to 1970s-style stagflation.

Source: Donald Trump

A somewhat similar risk confronts Britain. There, the problem is not that the currency is strong; it is that it has fallen precipitously since the Brexit referendum. British devaluations tend to feed through to prices quickly, so the Bank of England will have to raise interest rates to head off import-driven inflation. As with its counterpart in the United States, raising interest rates will leave the Bank of England politically exposed. Already, the prime minister and other senior politicians have raised questions about its policies, accusing it of exacerbating inequality with its unconventional “quantitative easing” and of interfering in politics during the referendum. Again, it is easy to imagine this smoldering kindling of resentment turning into a full inferno of attacks if the central bank raises interest rates in the face of a stagnating, Brexit-hit economy.

These are early days in the populist revolt, and it is impossible to know the endgame. More populists may be elected – the most consequential near-term threat is to be found in France – or the movement may peter out under the weight of its own confusions. President-elect Trump, who is capable of giving several answers to any one question, may turn out to be far more moderate than his rhetoric threatens – or, alternatively, more radical. But this very uncertainty is itself the point. By instinctual hostility to the expert consensus, the populists are announcing that almost any policy direction is conceivable. Companies, investors and ordinary citizens are left guessing. It will be harder to build a factory or start a firm, because the sheer unpredictability of the new world makes every step ahead feel risky.

Sebastian Mallaby is the Paul A. Volcker Senior Fellow for International Economics at the Council on Foreign Relations and the author of The Man Who Knew: The Life & Times of Alan Greenspan, winner of the 2016 FT/McKinsey Business Book of the Year prize.